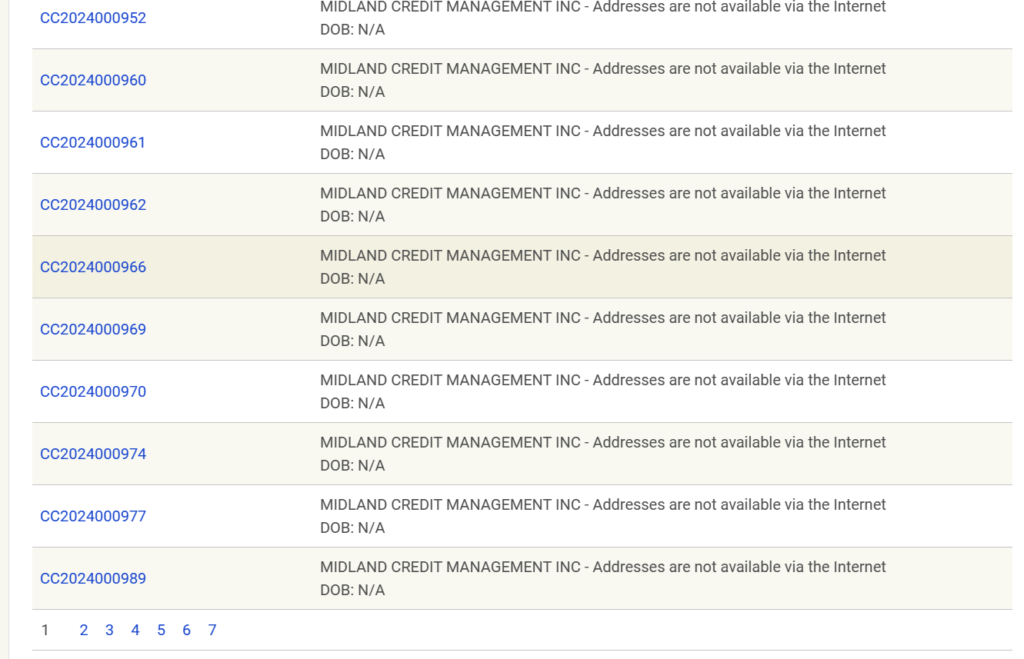

On January 2nd, 2024, the junk debt buyer Midland Credit Management has sued 122 people in Maricopa County Arizona for charged-off debt alone. This is just one county and one company in one day! This data and screenshot below were obtained from the Justice Courts of Maricopa County website.

Can you imagine how many people are being sued by Midland Credit Management in Arizona, your state, or the United States? Midland Credit Management sues a lot!

The only reason why Midland Credit Management and other junk debt buyers sue so much is because around 95 percent of the time, consumers do not file an answer to the lawsuit, permitting the junk debt buyers to get a default judgment.

Fortunately, you have the option to fight back against these bogus lawsuits. If you file an answer to the lawsuit and dispute the junk debt buyers claim, junk debt buyers like Midland Credit Management will be forced to prove their case. Most of the time, junk debt buyers are not prepared to provide the evidence they need to win.

If 95 percent of people answered the lawsuit and contested the allegations, junk debt buyers would go out of business; it would be too expensive and time consuming to actually work thousands of cases a month.

If you need help filing an answer to a junk debt buyer lawsuit for credit card debt or other debt, consider working with us. We will be in your corner and do everything we can to help you ensure shoddy companies like Midland Credit Management dismiss your case and run away. Email us at [email protected] to get started.